Welcome to G-Saving App

G-saving App is a community empowerment platform that brings transparency, efficiency, and security to group savings. Move away from manual record-keeping and embrace modern, automated management of your collective financial efforts.

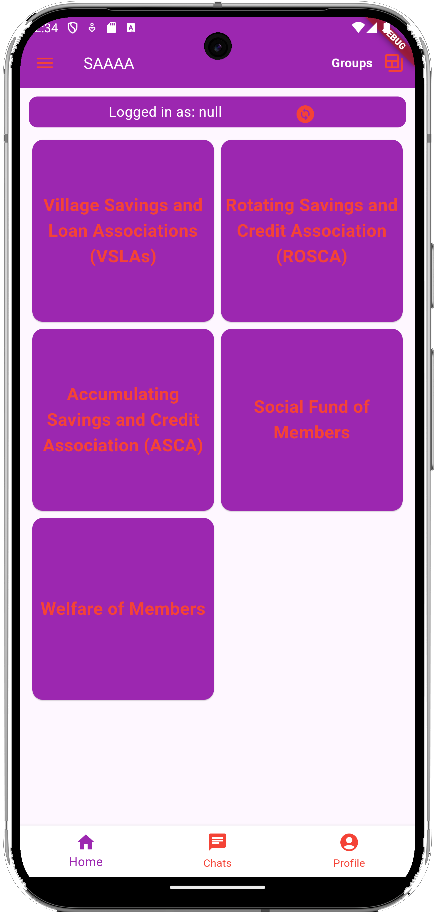

A five in one Scheeme

The App supports up 5 saving, credit and networking groups

Village Savings and Loan Associations (VSLAs)

VSLAs are community-based microfinance groups where members contribute savings to a common fund.The fund is used to provide loans to members for various purposes, such as starting or expanding small businesses, paying school fees, or covering emergency expenses.

Rotating Savings and Credit Associations (ROSCAs)

In a ROSCA, a group of individuals agrees to contribute a fixed amount of money to a common pool at regular intervals, such as weekly or monthly.The total pool is then given to one member of the group in rotation, providing each member with a lump sum at regular intervals.ROSCAs are often used for short-term savings or to meet immediate financial needs.

Accumulating Savings and Credit Associations (ASCAs)

ASCAs function similarly to ROSCAs but with the aim of accumulating savings over time.Instead of rotating the lump sum among members, the total pool is retained by the group and loaned out to members as needed.

Social Fund of Members

Social Fund, This functions like a collection pool for members to support each other to overcome small issues or emergecies. Funds is like ASCAs only that loans are offered in small quantities, without interest for a small period like a week. If a member fails to pay back in a week time they roll the money tobecome a loan but still to be paid back in a weeks time. so it grows just like any other loan.

Welfare

The Welfare Fund in groups is generally set up to offer members financial assistance in specific situations, often related to health, education, or emergencies. Welfare funds are often funded by regular contributions from group members and are managed collectively to benefit members in times of need. Here’s how it typically operates:

App supported features

The App is fully equipped to support groups in the following ways.

Group Savings Management

Monitor collective savings in real-time, set targets, and track contributions. Ensure every member’s savings are accurately accounted for, promoting trust and transparency.

Loan Tracking

Easily track loans, repayments, schedules, and outstanding balances. Prevent mismanagement, reduce defaults, and keep members accountable.

Welfare Contributions and Subscription Fees

Manage welfare contributions, insurance schemes, and subscription fees

with ease. Keep track of dues, ensure timely contributions, and maintain

financial sustainability.

Real-Time Reporting and Notifications

Generate detailed reports for savings, loans, and contributions. Get notifications for dues, payments, or scheduled contributions to avoid delays and miscommunication.

Enhanced Security

Your financial data is protected with advanced encryption and access controls,

ensuring only authorized members access sensitive information.

User-Friendly Interface

G-saving App’s intuitive design makes it easy for anyone to navigate, input data, and generate reports, even with minimal tech experience.

Cross-Platform Support

Access the app across smartphones, tablets, or desktops. Stay connected to your group’s financial progress wherever you are.

Administrator Controls

Group leaders can manage settings, approve transactions, and oversee contributions and loans for higher accountability and accuracy.

Comprehensive Data Backup

G-saving App regularly backs up all data, ensuring important financial records are safe and recoverable.

Join 50+ Groups

Follow your group activities at your confort zone